If you read our introduction to Medicare, you now know Original Medicare will not necessarily cover all of your health expenses. You may wonder how you will pay for expenses that Medicare does not pay for. Enter Medicare Supplement coverage, most commonly known as Medigap.

As the name somewhat states, Medigap helps you cover the “gaps” of medical costs Medicare expects the patient to pay.

What does Medigap cover? How much does it cost? Do I get nationwide coverage? We will be answering these questions and a lot more throughout this article.

What does Medigap cover?

To understand what Medigap covers, it is always helpful to review what Medicare does not cover. Here is a brief summary of what Medicare may not pay for:

- 20% of all your medical costs

- Deductibles

- Coinsurance

- 15% of excess charges

- First 3 pints of blood

- Foreign travel emergencies

Medigap can pay for some or all of these costs not covered by Medicare.

You may already know that Medicare covers you up to 80% of your doctor and hospital expenses. A Medigap plan can pay for the remaining 20%.

Medigap can also pay for deductibles. Medicare Part A has a deductible of $1,736, and Part B has a deductible of $283. Most Medigap plans will cover your Part A Deductible, and a few will even cover your Part B Deductible too.

Certain Medigap plans, like Medigap Plan G, can also cover the 15% excess charges that many doctors and facilities pass on to you, as well as the first 3 pints of blood not covered by Medicare. Medigap plans can also cover up to $50,000 in foreign travel emergency costs.

Given all of these benefits, it is easy to see why Medigap enrollment has been increasing.

Medigap Options

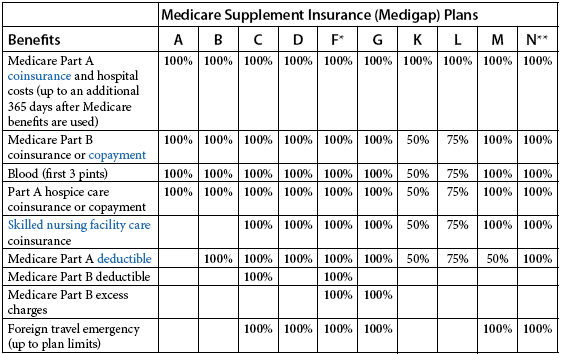

All Medigap plans are standardized and given letters to represent different plans. This means that no matter which insurance company offers Medigap, they will have the EXACT same network and benefits as any other company offering the same lettered plan.

There are currently 10 different lettered Medicare Supplement plans available for purchase in all states except Wisconsin, Minnesota, and Massachusetts. Let’s take a general look at what each plan covers.

As you may have noticed in the chart above, some plans like F and G stand out because their coverage is far greater than the others. Those are the ones you want to consider.

Why? Because they offer better coverage and they don’t generally cost more than the ones that cover less! We know, it’s a little weird. It has something to do with risk. Oftentimes, the more members a Medigap plan has, the less risky it is to the insurance company. This means a popular plan with rich benefits can cost less than an unpopular plan with limited benefits.

The majority of all individuals who select Medigap only purchase 3 plans: Plan F, Plan G, and sometimes Plan N. These are, by far, Medigap’s Most Popular Plans by enrollment. Unfortunately, Plan F is no longer available for purchase for those new to Medicare after Jan 1, 2020. If you recently turned 65 you will want to consider Medigap Plan G as your top choice.

This table shows how Medigap Plan G and Plan F complement Original Medicare (Medicare Part A and B)

| Benefits | Original Medicare Alone | Original Medicare With Medigap Plan G | Original Medicare With Medigap Plan F |

|---|---|---|---|

| Doctor Network | All Doctors who accept Medicare | All Doctors who accept Medicare | All Doctors who accept Medicare |

| Part A Hospital Benefit Period Deductible | You pay $1,736 | You pay $0 | You pay $0 |

| Hospital days Coinsurance | You pay $434 per day for days 61-90, $868 per day for 60 lifetime reserve days | You pay $0 | You pay $0 |

| Skilled Nursing Facility Coinsurance | You pay $217 per day from Day 21-100 | You pay $0 | You pay $0 |

| First 3 Pints of Blood | You pay 100% | You pay $0 | You pay $0 |

| Part B Annual Deductible | You pay $283 | You pay $283 | You pay $0 |

| Part B Copays/Coinsurance | You pay 20% (Part B deductible applies) | You pay $0 after Part B deductible | You pay $0 |

| Part B Excess Charges | You pay 100% (Part B deductible applies) | You pay $0 after Part B deductible | You pay $0 |

|

Foreign Travel Emergency (up to $50,000) |

You pay 100% | You pay 20% after $250 deductible | You pay 20% after $250 deductible |

NOTE: Medigap Plan F and Plan G also have high-deductible versions that first require a $2,950 deductible.

Medigap with Extra Benenfits

If you live in certain states, you will also find similar plans with an additional word added to their title such as:

These plans have the same core coverage and use the same network as their lettered plan, but also add additional benefits like hearing and vision. If you live in a state where those plans are available, you should definitely consider them.

How much does Medigap cost?

You may be thinking something along the lines of, “Medigap thing sounds amazing and it’s everything I have ever dreamed of, but is it something I can actually afford?”

Several factors will affect your price. The state you live in, the insurance company you choose, your age, the plan’s pricing system, discounts you can find, and even tobacco use can all affect your plan.

The easiest way to see how much Medigap will cost you is to get a Medigap quote here. You will see pricing within 30 seconds and you will not be required to speak with an agent.

That being said, Medigap plans can range from under $40 (for a high deductible plan) to over $300 depending on your age and zip code. Plan F is usually the most expensive of the popular options because it also covers your Part B deductible. Medigap Plan G, which doesn’t cover the Part B deductible, usually allows you to save much more than that in the form of lower monthly premiums. This is usually the plan we recommend.

We have written a full article on Medigap costs, so check it out if you need more information. One thing is for sure. your Medigap’s monthly cost will increase in the future so budget for that when selecting a plan.

When should you enroll in Medigap?

The best time to enroll in Medigap is when you are both age 65 or older AND enrolled in Medicare Part B. This is either called your Open Enrollment Period or Initial Enrollment Period depending on who you talk to. You have 6 months from your Medicare Part B effective date to enroll in Medigap, where you are guaranteed to be approved at the best rate regardless of your health history. You cannot be turned down or be subject to waiting periods because of pre-existing conditions if you enroll during this time frame.

If you have missed your Initial Enrollment Period, there are still ways for you to enroll. If you are enrolled in Medicare Part A and B but have coverage through work or a spouse, you may qualify for a Special Enrollment Period to enroll in Medigap. Again, you will not need to answer any medical questions, called medical underwriting*.

If you missed your Initial Enrollment period and do not qualify for Special Enrollment, you can still enroll at any time but you may have to answer medical questions. You could be turned down for pre-existing conditions during the medical underwriting process*.

On the plus side, if you are late to enroll in Medigap, there is no need to worry about penalties. Unlike Medicare Part B and Medicare Part D, Medigap does not have late enrollment fees.

If you are under 65 and qualify for Medicare because of a disability or End Stage Renal Disease, check out our article where we break down Under 65 Medigap State Rules.

* Want to avoid the hassle of a denied application? Use our AI Medigap Underwriting Checker to find out your approval chances before applying. It’s a simple tool that can save you a lot of time.

Medigap’s Doctor Network

Medigap does not have its own doctor network. Your doctor network will be the same as Medicare’s. Any doctor or facility that accepts Medicare must accept Medigap. Please re-read that last line because so many of our clients cannot believe it. Nationwide coverage is included in your Medigap plan because Medicare’s network is nationwide. And just like Medicare, you will not need a referral to see a specialist.

Exception: Medicare has no coverage when traveling abroad. Medigap plans, however, can help cover foreign travel emergency expenses. The network for coverage abroad works differently. For added protection on any trip, consider international travel insurance. Explore IMG’s travel insurance options to stay fully covered.

Which Medigap insurance company should I choose?

You may remember that we said that since Medigap is standardized. This means that every company that offers Medigap has to offer the same benefits and use the same network as other plans with the same letter designation. This means that all lettered plans are the same. Companies are allowed to offer gym membership or access to a nurse line as an added perk but the core benefits from a plan G are the same from one company to the next.

So if insurance companies are basically selling the exact same plans, which company do you go with? In many cases, you can select the plan with the best price. Any loyalties that you have to certain insurance companies can usually be thrown out the window. Medigap is the silent secondary payer to Medicare. This means they cannot differentiate with service. They do what they are told by Medicare. Since the network is the same and the service is the same, look for the best price.

The best price should factor in discounts. You can save money with some carriers by selecting autopay, signing up for a Medigap Household discount, a Medigap Roommate Discount or, even finding a New to Medicare discount. Th New to Medicare discount offers a discount of up to $30 a month if you apply for Medigap when you first become eligible for Medicare Part B. This discount is only available with certain carriers in California (call 800-930-7956 for details).

The best price should also be with the insurance provider that is less likely to increase costs in the future because switching Medigap plans can be hard (see the section below). It is hard to determine which companies will keep prices down in the long run but our Senior65.com team can help you with that.

Switching Medigap plans

Medigap does not have an annual open enrollment period to switch plans in most states. This is another statement that is worth re-reading since most of our clients assume that can switch Medigap plans each year. Unless you qualify for special enrollment or live in an area with state-specific Medigap switching rules, you may have to go through Medical underwriting and answer about 20 questions about your health before getting approved for a different Medigap plan. This is important because it means that you may not be able to switch Medigap plans if you have certain pre-existing conditions.

You don’t need to apply just to find out you won’t be accepted. Our Instant Medigap Underwriting Checker lets you know in advance if you’re likely to get approved. It’s quick and free.

Where to go next with Medigap?

If you want to learn more about Medigap, the next step is to see Medigap pricing in your area. If you are not sure if Medigap is right for you, check out Medigap vs Medicare Advantage Decision Assistant. This will ask a few questions to help you decide what Medicare insurance is right for you.

Remember you can always talk to one of our licensed agents who will help you review your options and enroll in the best plan for you. There is never a fee for our services and, since Medigap pricing is regulated, no one can sell the same plan for less than we do.