Our clients often ask us, “Which Medigap plans are the most popular?” This answer is easy but this is different from which Medigap insurance provider is the best. We will address both below. Note: This article has been updated in 2025 to reflect new trends in Medicare Supplement insurance, with the most recent data from America’s Health Insurance Plans from 2022.

Which Medigap plans are the most popular in 2025?

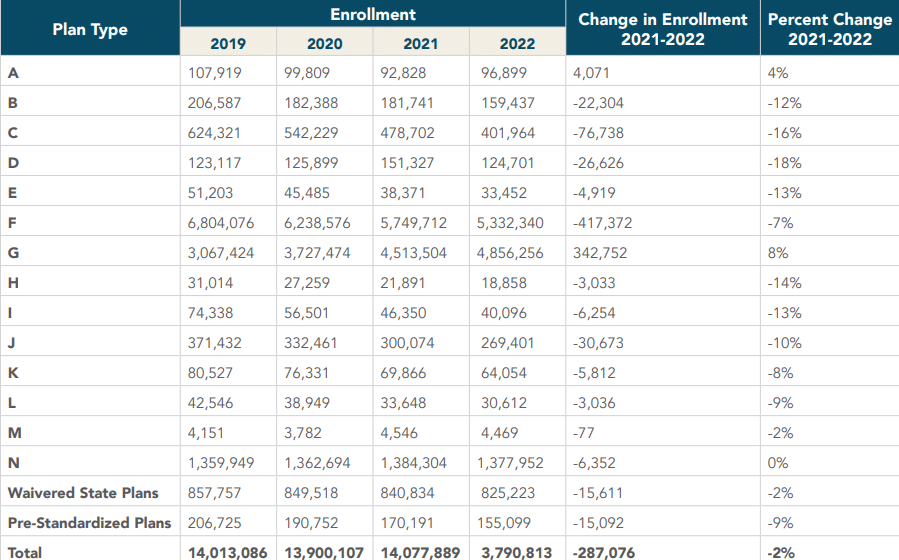

As you may know, Medigap underwent some changes back in 2020, which means that the Medigap plans worth considering also changed. The big news is that Plan F, which at the time of this writing had the largest number of enrolled members, can no longer enroll those new to Medicare. Plan F was the most popular but not anymore.

(Image source AHIP)

Medigap Plan G is the fastest-growing policy in America.

Plan G is the most popular Medigap plan for those people who turned 65 after January 1, 2020 with over 4.5 million enrollees. Because Plan F is no longer available to those new to Medicare, Plan G is the fastest-growing Medigap plan in America. According to AHIP report State of Medigap 2024, the percentage of people who are enrolled in Medigap Plan G grew by 8% in 2022 (most recent data available).

Is Popular Medigap the same as Best Medigap?

Yes and no. A popular Medigap often means that others have done their research and have selected it because it is a good price value. But popular policies usually also carry less risk for the insurance carrier because of increased enrollment of healthy people. Since they carry less risk they are often not subject to higher increases due to medical loss ratio. So popular plans become sell fulfilling as more and more people join them, and insurance providers can keep the price down (which makes them even more popular!). This is why we rarely recommend less-popular plans like Medigap Plan L or Medigap Plan M since their enrollment is so low they can rarely offer a good price value.

However, some plans (like the Innovative Plans with extra benefits) are not as popular but should be considered. Get an instant Medigap quote here to see for yourself.

Our Recommendations If you are new to Medicare in 2025

- Medigap Plan G: In most cases, this is the best option. It covers the most benefits possible at usually the most competitive prices. Even if you could purchase Plan F (in spite of the 2020 changes), Plan G usually is a better deal. You can compare Medigap G and F here to see how we came up with that recommendation.

- Medigap Innovative G or G Extra: These plans offer the same coverage as Plan G, but also cover some hearing and vision benefits. As of now, you can find G Extra and Innovative G in California. You can also find Innovative G in Nevada. Check out our Ultimate Guide to Medigap plans with Extra Benefits.

- Medigap Plan N: Plan N is a good plan as long as you live in a state that doesn’t allow for Medicare’s excess charges. Plan N is the third most popular plan in terms of total enrollment after Plan F and Plan G but still has less than 1/8 the total enrollment of the other two plans (source AHIP).

Which Medigap Insurance Provider is the Best?

While Medigap plan G is the most popular, the next step is to find out which insurance company that offers plan G is the best for you. The best way to do that is to give us a call at 800-930-7956. We can help you go over pricing and share what we know about top providers in your area. If you prefer to do your research on your own, click on the links below.

Get a Medigap Quote Enroll in Medigap

Next Steps to Enroll in a Medigap Plan

Give us a call here at Senior65.com and we can help you enroll at no cost to you. We hold licenses in over 45 states and work with leading Medicare insurance providers like Aetna, Anthem, Blue Cross, Blue Shield, Care First, Cigna, Humana, Mutual of Omaha, and United American.

There is never a fee or hidden charge to work with Senior65.com. Since Medicare Insurance pricing is regulated, no one can sell the same exact plan for less than we can.