Whether you’re new to Medicare or reevaluating your coverage, understanding Medigap cost in 2026 helps you make smarter financial decisions. Let’s explore what you’ll pay, what influences those rates, and how to find the best value.

Key Factors That Affect Your Medigap Cost in 2026?

If you’re comparing Medigap cost in 2026, here’s the simple truth: benefits are standardized, but prices aren’t. You could pay anywhere from about $50 to $350+ per month depending on your situation. The lettered plan you pick (G, N, or High-Deductible G) always has the same core coverage across companies—what changes is price, pricing method, discounts, and perks.

While this article will explain how Medigap costs work, the only way to see your price is to get a 2026 instant Medigap quote here https://www.senior65.com/quote. You can leave off your name and contact info if you want to be anonymous.

What drives your monthly premium

- Plan letter: More coverage usually means a higher premium; cost-sharing plans (like N or HD-G) tend to be cheaper each month.

- ZIP code & state: Local medical costs, competition, and state rules can move prices up or down.

- Age & pricing method: Some companies raise rates as you get older (attained-age), others lock your entry age (issue-age), and some charge the same to everyone (community-rated). More on this below.

- Tobacco status: Many insurers add a surcharge if you use tobacco.

- Household/other discounts: There are many discounts including autopay. A few states offer “new to Medicare,”discount for the first year. Some insurance providers give you a discount if there is another adult living in the same house (see section below)

- Under-65: In most states, premiums for those under 65 are higher (and options can be limited).

👉 Want real numbers for your area? Check our Instant Medigap Quote Tool—fast, free, and no email required.

Does Your Age Impact Medigap Cost in 2026?

Short answer: often yes—but it depends on how your insurer prices policies in your state. Age can matter at sign-up and over time.

How age can change what you pay

- When you enroll: Joining at 65 (during your Medigap Open Enrollment) usually set you up for the best available rate with no health questions.

- As you get older: With attained-age pricing (most common), your premium generally increases with your age. With issue-age, your premium is based on the age you were when you bought the policy. With community-rated, everyone pays the same base rate regardless of age. Note: All three plans tend to increase their premium each year due to inflationary “rate actions.”

- Under-65 (disability): Expect higher premiums in many states. When you later turn 65 and start Part B, you usually get a new Medigap Open Enrollment Period with better pricing options.

How Insurers Price Medigap: Community-Rated, Issue-Age, and Attained-Age

Not all Medigap premiums are calculated the same way. If you’re comparing Medigap cost in 2026 you may hear about Community-Rated, Issue-Age, and Attained-Age. We explain them here but, frankly, you shouldn’t focus on them because issue age and community rated plans still increase each year in the form of annual “rate action.” Focus on who has the best price not on their pricing system.

The 3 pricing methods at a glance

| Pricing Method | How It Works | What It Means Over Time | Good To Know |

|---|---|---|---|

| Community-Rated | Everyone pays the same base rate in your area, regardless of age. | Premium changes usually come from inflation or company-wide adjustments, not your birthday. | Many companies offer a disappearing discount to younger members so the price appears to go up as you get older. |

| Issue-Age | Your rate is based on the age you are when you first buy the policy. | It won’t increase because you get older, but it can rise for inflation or claims trends. | These plans seems to start off higher and go up each year due to “rate actions” for everyone. You will not be “locked in” to your issue price for life. |

| Attained-Age | Your rate is based on your current age and typically goes up as you age. | Expect birthday-based increases plus occasional company adjustments. | Most companies in America offer Age Attained pricing. |

👉 Still unsure? Our team can walk you through real examples for your ZIP code—call 800-930-7956.

Medigap Cost in 2026 for Plan G, Plan N, and High-Deductible G

Plans are standardized by letter, so benefits for a given letter are the same across companies. What varies is the premium and how you share costs at the point of care. Here’s the practical, side-by-side view many of our clients find helpful:

| Plan | Monthly Premium (Relative) | What You Pay When You Use Care | Excess Charges Coverage | Best For | Trade-Off |

|---|---|---|---|---|---|

| Plan G | Higher | You pay the Part B annual deductible, then most Medicare-approved costs are covered. | Yes | Predictable bills and broad protection. | Higher monthly premium for peace of mind. |

| Plan N | Medium/Lower | Small copays (up to $20 for office visits; up to $50 for ER if not admitted). Part B deductible applies. | No | Lower monthly cost if you’re OK with occasional copays. | Doesn’t cover Part B excess charges; minor copays apply. |

| High-Deductible Plan G | Lowest | You pay Medicare cost-sharing until you meet the annual high deductible; then it works like Plan G. | Yes (after deductible) | Healthy buyers who want the lowest premium but a safety net for big events. | Higher out-of-pocket risk in a heavy-usage year. |

How to read this if you’re choosing today

- Want simplicity and predictability? Many seniors prefer Plan G.

- Want a lower monthly bill and don’t mind small copays? Consider Plan N.

- Comfortable with more risk to save the most each month? Look at High-Deductible G.

👉 Need more detail? Compare Medigap G VS N here

How Much Does Medigap Cost in Your State?

When people ask about Medigap cost in 2026, the next question is almost always: “What about my state?” Prices vary by location because of local medical costs, competition among insurers, and state rules. The benefits for a given letter (G, N, or High-Deductible G) are the same everywhere, but monthly premiums can look very different from one ZIP code to the next.

Why your state matters

- Local pricing: Insurers file rates by state (and often by county/ZIP).

- State rules: Birthday/Anniversary Rules, year-round GI, or under-65 protections influence participation and pricing.

- Plan availability: Not every carrier offers every letter in every state.

- Special states: Massachusetts, Minnesota, and Wisconsin use alternative Medigap designs (not the A–N letters), but benefits are still standardized within each state’s system.

| State Factor | How It Can Affect Your Premium | What You Can Do |

|---|---|---|

| Local medical costs & insurer competition | Higher local costs or fewer carriers can mean higher premiums. | Compare multiple companies for the same letter plan. |

| State switching protections (e.g., Birthday/Anniversary Rules) | Can make switching easier, which may increase competition (and sometimes stabilize prices). | Learn your state’s rules before you buy—switching later might be easier than you think. |

| Under-65 Medigap availability | Where available, under-65 rates are often higher; turning 65 usually opens better pricing. | Re-shop at 65 when you get a new Open Enrollment window. |

| Pricing method (community/issue/attained) | Changes how your premium may rise over time. | Check the pricing type on each quote |

👉 The fastest way to see your numbers: use our Instant Medigap Quote Tool (ZIP, age, start date—no email). 📞 Prefer a walkthrough? Call 800-930-7956 and we’ll read quotes with you, line by line.

Discounts That Lower Your Monthly Cost

Good news: many carriers offer small discounts that can make a real difference over a year. These don’t change your benefits—just your price.

| Discount | Who Qualifies | How It Works | Fine Print |

|---|---|---|---|

| Household / Roommate | Two people living at the same address (often both on Medigap) | Percentage off the monthly premium | Rules vary—sometimes available even if the other person isn’t on the same plan |

| Autopay / EFT | Anyone who sets up automatic bank draft | Small monthly credit usually $2-$3. | Usually applies to checking/EFT; credit cards may qualify! |

| Annual Pay | Members who pay a year at a time | One-time % savings on the year’s premium | Only a few providers offer this. |

| New-to-Medicare | First enrolling when Part B starts | Intro discount for your first policy year(s) | Amount and duration vary by carrier. Only available in a few states |

| Gym / Wellness Perks | Members who enroll in eligible programs | Either a premium discount or a free/low-cost fitness benefit | Not every company offers this; benefits differ by state |

How Enrollment Timing Affects Your Premium

When you look at Medigap cost in 2026, when you apply matters almost as much as which plan you pick. Timing can mean getting the best available rate with no health questions—or facing underwriting and potentially higher premiums.

| When You Apply | What It Means for Your Premium |

|---|---|

| Medigap Open Enrollment (6 months starting when you’re 65+ and Part B active) | Best window. No medical underwriting. You can buy any plan letter at the carrier’s best rate for your age and ZIP. |

| Guaranteed-Issue (special qualifying events) | No health questions for certain plans. Typically after events like losing employer coverage or MA plan changes; rates are protected. |

| Outside protected windows | Medical underwriting usually applies. You may be approved at standard rates, approved with a higher premium, or declined. |

| Under-65 (disability) then turning 65 | Many states have higher under-65 rates. When you later turn 65 and start Part B, you get a new Open Enrollment with better pricing options. |

👉 See today’s rates in your ZIP with our Instant Medigap Quote Tool (fast, free, no email).

State Rules That Can Affect Price (and Switching)

Your benefits are standardized, but state rules can change how easy it is to switch and how competitive pricing is in your area. Some states make plan changes simpler—which can help keep rates in check.

| Rule Type | What It Does | Examples | Why It Matters |

|---|---|---|---|

| Birthday Rule | Lets you switch to equal or lesser benefits around your birthday without underwriting (state-specific details apply). | Available in certain states such as California and Oregon. | Easier switching can increase competition and help you land a lower premium. |

| Anniversary Rule | Provides a window each year to change carriers (usually same plan benefits) without underwriting. | Missouri. | Gives you a yearly chance to shop price without health questions. |

| Year-Round Guaranteed Issue | Allows switching or enrolling in Medigap without underwriting at any time (state-specific rules apply). | Connecticut, New York. | Maximum flexibility to re-shop if your premium climbs. |

| Alternative Medigap Designs | States with non-A–N designs (benefits still standardized, just labeled differently). | Massachusetts, Minnesota, Wisconsin. | Plan names differ, but the “same letter = same benefits” idea still holds within each state’s system. |

| Under-65 Access Rules | Some states require Medigap availability for under-65 disability—often at higher premiums. | Varies by state. | If you qualify before 65, expect different pricing; re-shop at 65 for better rates. |

How to Use Our Quote Tool to Check Your Medigap Cost Instantly

You don’t need a spreadsheet (or a headache) to compare prices. Our Instant Medigap Quote Tool shows real rates for your ZIP code in under a minute:

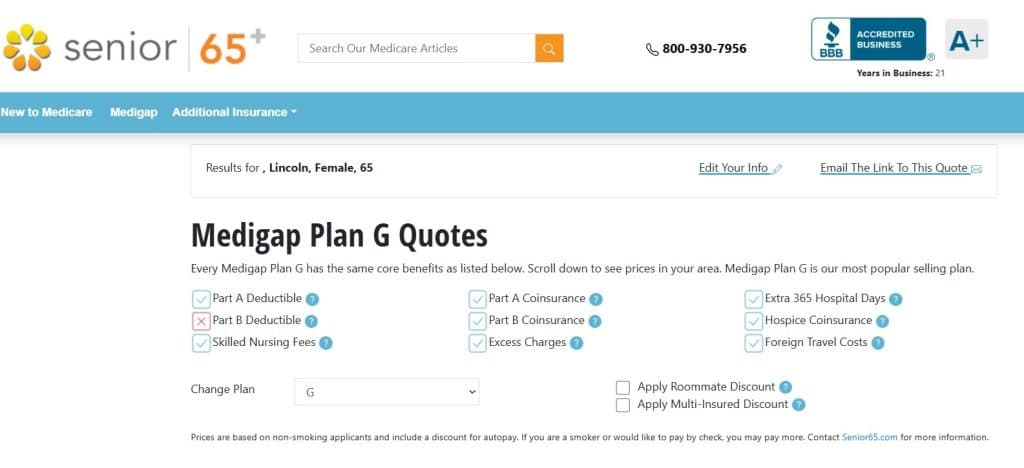

- First, head over to our Instant Medigap Quote Tool and you’ll see this screen:

- Fill in your details and click “See My Instant Medigap Price.” You don’t need to your personal contact info to receive a quote. Note: You must enter your date of birth, ZIP code, and county to get a result.

- In this example, we’re looking at a woman from Lincoln, Arkansas, born on 10/08/1960. By default, the tool shows Plan G, but you can use the dropdown arrow to switch to any available plan.

4. Scroll down a bit and you’ll see a list of companies offering that plan—along with their prices, pricing method (community-rated, issue-age-rated, or attained-age-rated), any extra benefits, available discounts, and whether you can enroll online directly from that link or need to call us so a team member can help you sign up. This service is completely free for you.

Will My Rate Go Up? Understanding Annual Increases and Stability

Short answer: YES—most Medigap premiums rise over time. The key is understanding why and how to keep things steady.

| Why Rates Go Up | What It Means | What You Can Do |

|---|---|---|

| Pricing method (attained-age) | Premiums tend to rise as you get older. | Not much. Community Rated and Issue age plans tend to go up each year as well in the form of Rate Actions. |

| Rate Action | Medical inflation & claims allow insurance companies to increase costs with state approval. Company-wide adjustments hit everyone in that plan. | Compare carriers’ rate history; re-shop if increases stack up. |

| State filings & regulations | A state may impose new rules such as “the Birthday rule” for easy switching that could impact future costs. NY has guaranteed issued plans for everyone at any time and they pay the highest premiums in the nation. | Know your state’s rules; some states make switching easier. |

| Book-of-business mix | An older or sicker pool can push rates higher. | Shop competing carriers offering the same letter plan. |

| Discount changes | Losing a household/roommate discount bumps price. | Notify your carrier if eligibility returns; ask about other savings. |

👉 Not sure if you can switch without medical questions? Try our Medigap Underwriting Checker to see your odds in seconds.

Tips to Save on Medigap Premiums Without Sacrificing Coverage

You don’t have to trade peace of mind for a lower bill. These moves can help you pay less while keeping strong coverage:

- Compare the same letter across carriers. Plan G is Plan G everywhere—benefits are standardized. Focus on price, pricing method, and discounts.

- Consider Plan N. Many seniors accept small copays to lower the monthly premium.

- Look at High-Deductible G. The lowest monthly premium with a larger yearly deductible—a good fit if you’re healthy and want a safety net.

- Grab easy discounts. Household/roommate, autopay/EFT, annual pay, new-to-Medicare, and occasional wellness perks. Learn all about Medigap Discounts here.

- Mind the timing. Enroll during Open Enrollment for best pricing with no health questions.

- Re-shop smart. Use state switching rules (Birthday/Anniversary/Year-round GI) to look for lower premiums later.

- Avoid tobacco surcharges. If you’ve quit, ask when your rate can be reconsidered.

👉 See which carriers are cheapest today in your ZIP with our Instant Medigap Quote Tool.

📞 Prefer guidance? Call 800-930-7956—we’ll tailor options to your health needs and budget.

Q&A: Quick Answers About Medigap Cost in 2026

Q: Is Medigap Worth the Cost?

A: For many seniors, Medigap means predictable bills and fewer surprises. But also is about simple billing (Medicare pays first; your Medigap plan follows automatically), freedom to see any doctor who accepts Medicare nationwide and even travel reassurance with certain plans that include limited foreign travel emergency benefits. Not sure yet? Read our full breakdown here: “Is Medigap Worth It? New report says 93% happy“.

Q: Why does my neighbor pay less for the same plan?

A: Likely age, ZIP code, discounts, pricing method, or state rules. Same letter = same benefits, but prices vary by profile. Get a free quote here. Source: Medicare.gov

Q: Will my premium change if I move to another state?

A: Usually yes—price can change with a new ZIP/state, but benefits stay the same. Re-shop quotes when you move. Also, the rules can change in the new state you move to. For this, we recommend visiting our interactive map with all the states and selecting the one you’re interested in. There, you’ll find a detailed explanation of how Medigap works.

Q: Do the doctors I see affect my premium?

A: No. Medigap premiums don’t change based on providers. If a doctor accepts Medicare, they accept your Medigap plan. Another thing to keep in mind is that some states allow Excess Charges. While they’re not very common, we recommend reading our full article: “How to Avoid Medicare Excess Charges.“

Q: If I hardly use care, will my premium go down?

A: No. Medigap isn’t usage-based. Rates follow pricing method, state filings, and carrier adjustments—not individual claims.

Q: Can I lower my premium without switching plans?

A: Sometimes—add autopay/annual pay discounts, verify household eligibility, or adjust your effective date. If not enough, re-shop the same letter with other carriers. Want to go deeper? Our article has all the info you need: “Medigap: Discounts and Special Offers“.

Q: How often should I compare rates?

A: Check annually or when life changes (move, turning 65 from under-65 coverage, big carrier increase). Use our Underwriting Checker to see if a switch is realistic.

Next Steps

👉 Ready to see your price? Run our Instant Medigap Quote Tool now.

📞 Questions? Call 800-930-7956—friendly, licensed help at no cost to you.