Medicare is a good start but has gaps in its coverage. These gaps could cost a lot of money should you have certain medical needs or conditions.

Additionally, Medicare requires that you first pay deductibles before benefits begin. That is where Medicare Supplemental Insurance (Medigap) comes into plan.

Medigap is the nickname for all federally-regulated Medicare Supplement Insurance plans that “cover the gaps” and pay for deductibles required by Medicare. Remember Medigap is very different than Medicare Advantage Insurance.

What Does Medigap Cover?

Medigap pays many of the costs that are not covered under traditional Medicare. To understand what Medigap covers you must first know what traditional Medicare doesn’t cover.

Currently Medicare DOES NOT COVER the following benefits below:

- Your Part A Hospital deductible: $1,676

- $419 per day per day for days 61-90 of a hospital stay

- $838 per day for costs for each hospital day stay per each “lifetime reserve day” after day 90 (up to 60 days over your lifetime)

- All hospital cost after your 60 lifetime reserve days have been exhausted.

- $209.50 per day for skilled nursing facility for days 21 through 100

- Your Part B deductible of $257

- 20% doctor’s fees and 100% of fees over the Medicare-approved amount for services

- The first three pints of blood per calendar year

As you can see, even with traditional Medicare, your medical costs can add up quickly. If you purchase a Medigap plan, some of the non-covered charges listed above will be covered.

If you select the plan that covers the most, Medigap Plan F, then all the “gaps” above are covered. This includes an additional 365 days of hospital coverage at no charge and up to $50,000 of coverage for Foreign Travel Emergencies.

How Much Does Medigap Cost?

The price of a Medigap plan varies based on your age, zip code and which plan you select – so you will want to get a quote to determine your specific price.

While all Medigap plans with the same letter have the same exact benefits, private insurance companies that offer them can charge different rates. For example, Blue Shield can sell a Medigap Plan G for $120 a month and Aetna can sell the exact same plan for $130.

When selecting a plan, your monthly price (called your Premium) is important since the benefits of the same lettered plans are identical.

Please Note: If you are almost 65, you will want to enter your quote birthdate as if you were 65. People 64 and younger pay significantly more for Medigap than those who are 65.

Which Medigap Plan Should I Select?

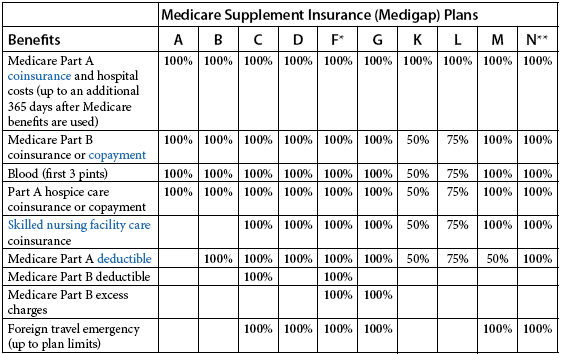

At first it may seem overwhelming trying to select which Medigap plan is right for you. There is a seemingly unending amount of lettered plans out there. Fortunately, since all of the Medicare Supplemental Plans are standardized, it is pretty easy to find a good fit for your needs. Medigap Plan F is the most comprehensive and the most popular supplemental plan. It covers the following:

- Basic and Preventive Care

- Part A Deductible

- Part B Deductible

- Part B Excess Charges

- Skilled Nursing and

- Foreign Travel Emergency

All Medigap plans other than Plan F will exclude at least one of the benefits above. As you get a quote from our site, you will quickly see which benefits other plans exclude and you can click into “details” to see if you value that benefit.

If you are not a traveler, for example, you may want to select a plan that doesn’t cover Foreign Travel Emergency as it will save you from paying for a benefit you will never use. Click on the “See Available Plans” below to compare coverage side-by-side.

How Do I Apply For Medigap?

The application process is fairly straight forward. First you get a quote by clicking the “Get Medigap Quote and Apply”. If you are almost 65, set your date of birth on the quote tool so that you are 65. People 65 often pay significantly less than 64.

From the quote tool, click on the apply link for the plan you like the best. You will be able to print out the application or, if available, apply directly online.

How can I switch Medigap Plans?

At some point, you may want to switch Medigap plans or stay on the same plan but work with a new (and cheaper) provider.

In both cases, you can change Medigap at any time, but it will require you to fill out a new application. You will most likely have to answer health questions on the new Medigap application.

Your application for a new plan could also be denied if you have certain pre-existing health conditions such as cancer. Save yourself the trouble of applying and getting turned down. Our AI Medigap Underwriting Checker lets you know ahead of time if you’re a good candidate for approval.

Special Circumstances for Switching Medigap

Some individuals may qualify to switch plans without going through medical review under special circumstances. The most obvious example would be if your old plan was terminated involuntarily because it is no longer being offered. Contact us if you think you might qualify for special circumstances.

Some states, such as California and Oregon, have special laws where you can switch Medigap providers once a year on your birthday month without having to review your health history. If you are unsure if your state has a special switching law, please contact us at the number at the top of this page.

How Can I Compare Each Medigap Plan?

Use the quick chart below to see each federally regulated Medicare Supplemental (Medigap) plan. If you would like to see much more comprehensive details of each plan, please visit our Medigap Plan Details page.

Can I Apply for a Medigap plan if I’m under 65?

There are two ways to apply for a Medigap plan if you are under 65:

- If you are almost 65 and preparing for Medigap you’ll want to click here for the Medicare Supplemental quote tool. Here’s the tricky thing, in most states to get the best price you need to be 65. So when getting a quote put your date of birth as the month after your future 65th birthday to get the proper quote.

- If you are under 65 and qualify for Medicare due to a disability or End Stage Renal Disease you might be able to enroll in a Medigap plan. Call the number above if you have any questions.

Check our updated article on Under 65 Medigap State Rules!

Medigap vs Medicare Advantage?

Medigap is the nickname of Medicare Supplemental Insurance plans that you purchase to fill in the 1000’s of dollars of “gaps” not covered in Medicare Part A (Hospital coverage) and Medicare Part B (Doctor coverage).

In most cases, unless you are on a very limited budget you will want to purchase a Medigap plan by clicking on the “Get a Medigap Quote” link below.

Medicare Advantage, on the other hand, is coverage you sign up for instead of Medicare part A and B. In fact, if you purchase a Medicare Advantage plan, you can no longer be enrolled in traditional Medicare.

Medicare Advantage plans are offered by private companies that cover the same benefits offered in Part A and Part B (as well as some additional benefits not found in traditional Medicare). Click here learn more about Medicare Advantage.

Plan Benefit

The benefits of Medigap plans are standardized by the federal government, meaning that Medigap plans sold by different insurance companies all offer the same benefits.

Medicare Advantage plans, in contrast, must provide at least the same coverage as Medicare A and B, but vary widely beyond this minimum set of benefits.

Doctor Networks

Medigap plans typically have a large network of doctors and facilities while Medicare Advantage plans usually have a smaller network. This varies by each Medicare Advantage plan provider. Those that travel extensively typically choose Medigap over Medicare Advantage for this reason.

Price

Medigap plans always require an additional monthly premium while some Medicare Advantage plans with less comprehensive benefits may have no monthly cost at all.

In the past Medicare Advantage plans were often cheaper than selecting a Medigap plan. Many of the Medicare Advantage plans, however, require significant cost sharing by its members should medical services be required.

Due to recent health care reforms, Medicare Advantage federal reimbursement have changed and many experts believe that future prices of Medicare Advantage plans will increase.

Conclusion

Because Medicare Advantage plans often have reduced benefits, we suggest enrolling in one if you are on a budget. If you can afford the extra amount each month, Senior65.com encourages enrolling in a Medigap plan. To speak to someone about Medicare Advantage or Medigap call 800-930-7956 x3.