If your Medicare Advantage (MA) insurance company has told you your plan will not be available next year, now’s the time to act. If you received an official termination of your current plan, we know it can be confusing. But since your MA is no longer offering services, you get a “free pass” to Medigap. We’ll guide you through every step.

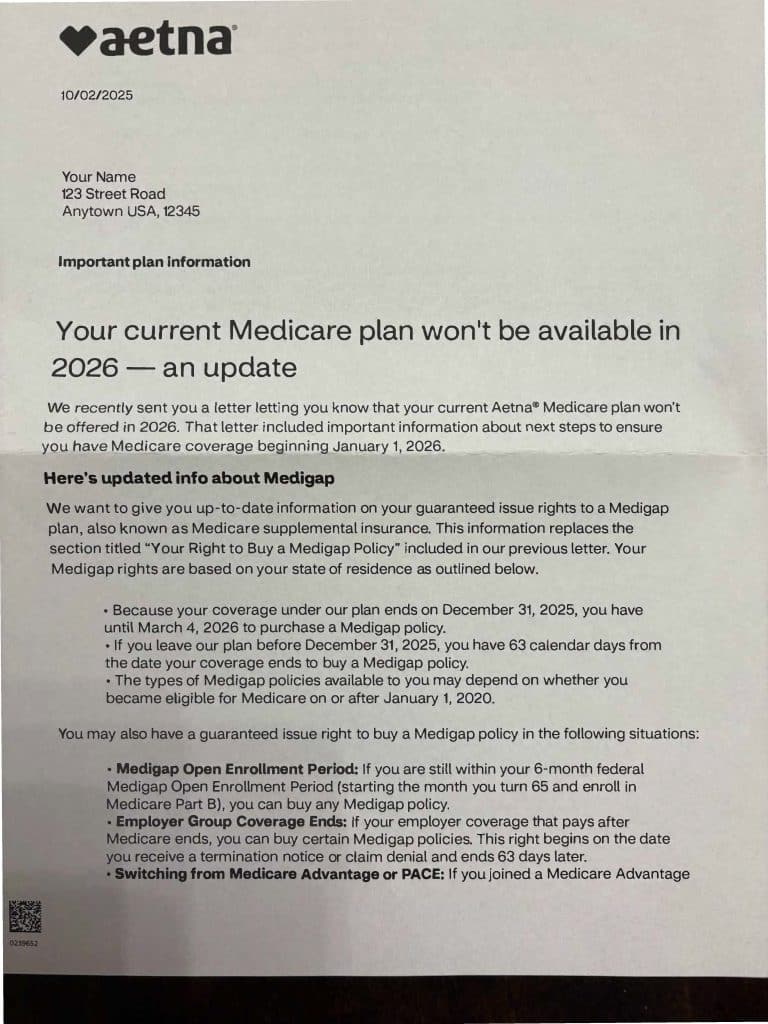

If you received a document like the image above, you will have until March 4th to switch to Medigap. We recommend applying for Medigap by Dec 31st. Read below to learn more.

Why Are Medicare Advantage Plans Ending in 2025?

More than a million Medicare Advantage members could lose their current coverage heading into 2026, and some of those changes are already starting. Big insurers are pulling out of certain areas or dropping PPO options that many seniors rely on. So… what’s going on?

The short answer: rising costs and tougher rules. Some companies find it too expensive to maintain these plans—especially in smaller or rural markets. Others are leaving because their plans didn’t meet Medicare’s performance standards or lost the high Star Ratings that keep them competitive.

Basically, costs are rising faster than revenue. MA insurers must now spend at least 85% of what they collect in premiums directly on patient care. Combine that with higher hospital and drug costs, plus new Inflation Reduction Act limits on pharmacy profits, and many insurers are stepping back.

If your plan is leaving your area, you’re not out of luck. In fact, that change should open a Special Enrollment Period to switch to Medigap (AKA, Medicare Supplement Plans). This gives you predictable costs and freedom to see any doctor who accepts Medicare—anywhere in the U.S. Source: Medicare.gov.

Get a Medigap Quote Enroll in Medigap

What to Do If Your Medicare Advantage Ends

If you’ve received a letter saying your Medicare Advantage plan is ending in 2025, don’t panic—but act quickly. That notice is your Annual Notice of Change (ANOC), and it confirms that your insurance company won’t renew your plan for next year. Sometimes it is called the “Right to Buy” doc. See example above. It should also explain your Special Enrollment Rights, which let you switch to a new plan or apply for Medigap. Without this document, Medigap usually requires health questions before your are approved on a new plan.

💡 Keep this letter—it proves your Guaranteed Issue eligibility when you apply for Medigap.

Risk of Coverage Gaps

If you take no action, you’ll be automatically moved back to Original Medicare (Parts A and B) on January 1. This creates two major issues:

- Problem #1: 20% Coinsurance. Original Medicare only covers about 80% of your outpatient costs, with no annual cap. You are fully responsible for the remaining 20% coinsurance. That’s why it’s smart to start exploring your Medigap options now.

- Problem #2: Loss of Drug Coverage. When your MA plan ends, you lose built-in drug coverage. You’ll need to enroll in a standalone Part D plan before the deadline.

Guaranteed Issue Rights: How to Switch to Medigap Without Underwriting

Here’s the silver lining: if your Medicare Advantage plan ends, you’re protected by Guaranteed Issue (GI) rights. That means you can enroll in a different Medicare Advantage OR certain Medigap plans without answering health questions.

But timing is everything. These rights typically last 63 days from the date your coverage ends. Many people with MA plans that leave the market will have until March 4 to enroll in Medigap. Miss that window, and you may have to go through medical underwriting, which could result in denial or higher premiums.

💡 Note: Those who were eligible for Medicare before 2020 can enroll in Plan F (but not plan G) and those who were eligible after 2020 for Medicare must select Plan G (but not plan F) using this SEP. Not sure which plans you qualify for? Our team can check for you in seconds—just call 800-930-7956.

Common Mistakes to Avoid When Your Plan Ends

Even with GI rights, many seniors make errors that cost them time, money, and better coverage.

- Mistake 1: Doing Nothing: Your current carrier will not automatically move you to one of their other plans. You must actively choose your next coverage.

- Mistake 2: Missing the Deadline: Your Special Enrollment Period (SEP) should allow you to enroll 63 days AFTER your coverage ends —but you must apply before December 31 for your new plan to start January 1.

- Mistake 3: Signing up for the Wrong Plan. If you joined Medicare in 2014 but apply for Medigap G using this SEP, you will be declined. As we said before, those who were eligible for Medicare before 2020 can enroll in Plan F (but not plan G) and those who were eligible after 2020 for Medicare must select Plan G (but not plan F) using this SEP.

📞 Need help timing everything? The Senior65 team can handle the paperwork and deadlines—so you don’t miss a step. Call 800-930-7956 for free, no-pressure help.

FAQs: Medicare Advantage Ending in 2025

Q: Will I lose all my Medicare coverage?

A: No. When your MA plan ends, you’ll automatically revert to Original Medicare (Parts A and B), so you won’t lose hospital or doctor coverage. But you’ll need to switch to a different Medicare Advantage plan OR add a Medigap and Part D plan to avoid high out-of-pocket costs.

Q: Can I switch to Medigap without medical questions?

A: Yes. You have 63 days of Guaranteed Issue Rights after your MA plan ends to select certain Medigap plans with no underwriting.

Q: When should I apply for Medigap?

A: As soon as you receive your termination notice. Applying early ensures a smooth transition for January 1. You can get a quote and enroll online here

Q: Can I use my GI rights to get the Medigap Plan N?

A: Yes, the GI rights granted in this scenario typically apply to Plans A, B, C, D, G, and N. Unless you were eligible for for Medicare before 2020. Then Plans A, B, C, D, F, and N are part of this special enrollment period.

💡 Tip: Use our Instant Medigap Quote Tool or call 800-930-7956 to see which GI plans are available in your ZIP code. Want help choosing the right plan? Our licensed agents are just a call away—and their help is always free.

Next Steps: Call Senior65.com

You’ve got this—and we’ve got your back. Don’t hesitate to call at 800-930-7956 or leave a question/comment below. Let’s make sure you start 2026 with the coverage you deserve.