Are you confused about the new Medicare Part D drug changes for 2025? Don’t worry, you’re not alone. This year brings significant improvements with a $2000 Maximum out-of-pocket limit and 3 easy phases. These changes will affect anyone on a Part D drug plan or a Medicare Advantage plan that includes prescription drugs.

New Part D Annual Maximum Out-of-Pocket Limit Starting 2025

The annual Maximum Out-of-Pocket limit (MOOP) for Medicare Part D plans is changing in 2025. This limit represents the most you’ll have to pay for covered prescription drugs in the calendar year. You can think of this number as the absolute maximum money that would literally come out of your pocket to pay for coverage of prescription drugs in one year. Starting in 2025, the MOOP will be set at $2,000. Once you reach this limit, your plan will cover the costs of covered prescription drugs for the rest of the year. Note: The Maximum out-of-pocket limit includes your deductible but does not include your monthly Part D premium.

Previously, the maximum payments could vary significantly between different Medicare Part D plans and, in some cases, could be very expensive. This change will provide more predictability and allow you to budget prescription drug costs. It also ensures that no one has to pay exorbitant amounts out-of-pocket for their medications. (Source: CMS.gov)

In the market for a Part D drug plan? Visit www.medicare.gov or check out PlanEnroll.com

Medicare Part D Drug Coverage Simplified Phases:

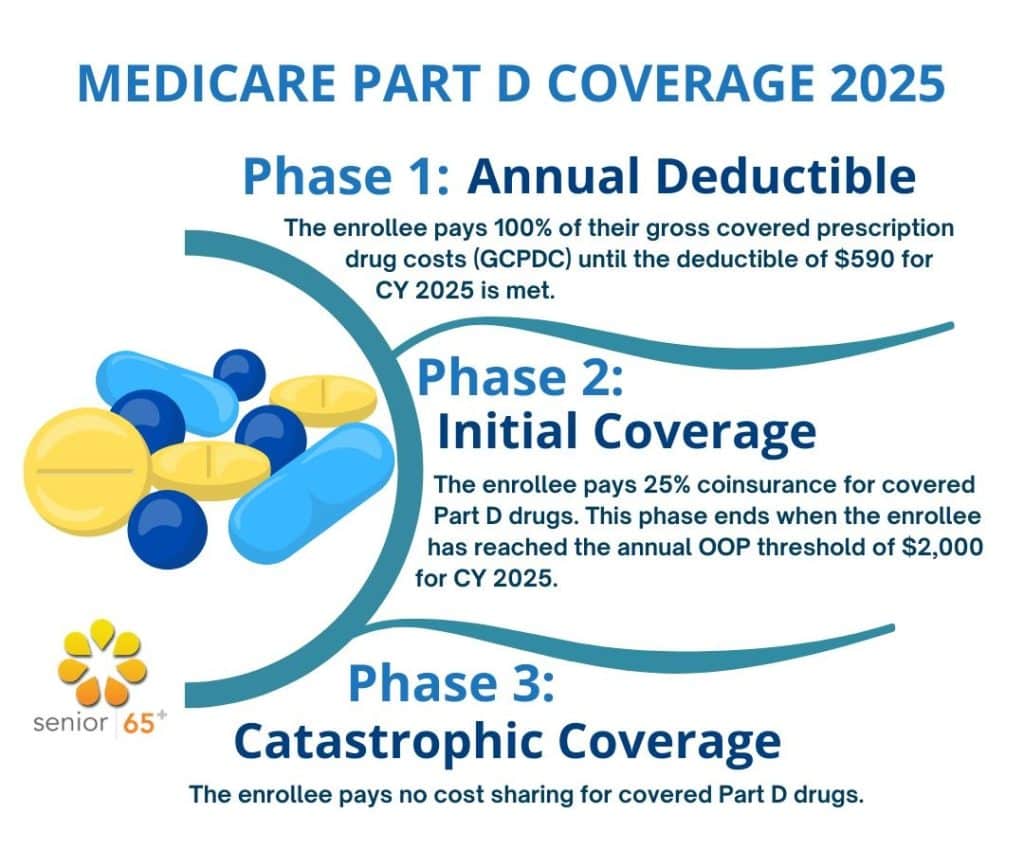

Starting in 2025, Part D plans have been simplified into 3 easy phases: 1) Deductible, 2) Initial Coverage, 3) Catastrophic coverage. Do you remember that “Coverage Gap” phase (AKA Donut hole)? That is no longer a thing for consumers to pay for in 2025!

Let’s review the three phases in detail below:

1) Medicare Part D New Annual Deductible Phase

In 2025 Medicare Part D plans will have a standard annual deductible of $590. This means you’ll need to pay the first $590 of your prescription drug costs each year before your coverage kicks in. In the past, the deductible was waived for certain generic drugs so that may be the case in 2025. If you are worried that you will not be able to pay this deductible all at once, please see the section below on Part D Payment Plans.

2) Medicare Part D Initial Coverage Phase

During the initial coverage phase of Medicare Part D, beneficiaries will pay 25% of the cost of their covered drugs until they reach the annual out-of-pocket limit ($2000). This means that you’ll have some cost-sharing responsibility, even after you’ve paid your annual deductible ($590).

3) Medicare Part D Catastrophic Coverage Phase

Once you’ve reached the annual out-of-pocket limit, you’ll enter the catastrophic coverage phase of Medicare Part D. During this phase, you’ll typically pay nothing for your covered prescription drugs for the rest of the year. Your insurance plan and Medicare will pick up the cost of drugs in this phase.

Note the change: Previously, beneficiaries paid 5% coinsurance during the catastrophic coverage phase. This has been reduced to a nominal amount which means that most beneficiaries will pay nothing for their covered prescription drugs in this phase.

2025 Medicare Part D Drug example

A fictitious Medicare Part D member named Harvey takes 3 expensive drugs that each cost $400 every month. Without a Part D drug plan, he would pay $1200 for all three prescriptions every single month. Below we will give an example of how Harvey’s part D drug payments would work in 2025.

January: Harvey goes to the pharmacy to pick up his three drugs which normally cost $1200. He must first satisfy his $590 deductible. He then still has to pay 25% of January’s remaining drug cost of $610 amount. 25% of $610 would be $152.50.

February: Now that Harvey has satisfied his one-time calendar year deductible, he only has to pay 25% of future covered drug costs. He pays 25% of his $1200 worth of drugs which equals $300 for February.

March – December: Harvey continues to pay 25% of his drug cost each month until he reaches a total of $2000 of out-of-pocket costs. In the chart below, you can see by June he has satisfied his MOOP of $2000 so he is done paying for all covered prescription drugs for the rest of the year. He will still have to keep paying his monthly premium for the rest of the year.

| Retail cost of drugs | Harvey’s payment toward deductible | Harvey Payment of 25% of drugs | Explanation | |

|---|---|---|---|---|

| January | $1200 | $590 | $152.50 | $1200-$590 deductible=$610. He pays 25% of $610 for the drugs after he sastified his deductible. |

| February | $1200 | $0 | $300 | 25% of drug costs |

| March | $1200 | $0 | $300 | 25% of drug costs |

| April | $1200 | $0 | $300 | 25% of drug costs |

| May | $1200 | $0 | $300 | 25% of drug costs |

| June | $1200 | $0 | $57.50 | His payment is smaller because he has reached his $2000 MOOP |

| July | $1200 | $0 | $0 | |

| August | $1200 | $0 | $0 | |

| September | $1200 | $0 | $0 | |

| October | $1200 | $0 | $0 | |

| November | $1200 | $0 | $0 | |

| December | $1200 | $0 | $0 | |

| Total | $14,400 | $590 | $1,410 | $590 deductible + $1410 in additional drug cost= $2000 MOOP |

2025 Medicare Part D Payment Plan

If you are tired of having high Part D drug costs in January because you haven’t satisfied your deductible, this new Part D Payment Plan might be right for you. Starting in 2025, Part D enrollees can opt into a new program that would spread their out-of-pocket costs over the year. You can learn more about this program here.

Medicare Part D Higher Premiums?

Now that insurance companies are required to cap out-of-pocket drug expenses at $2000, your monthly premium could be higher in 2025 than in 2024. The New York Times claims that average premiums will actually go down from $53.95 this year to $46.50 in 2025. That being said, many of our existing clients have called to let us know that their low-cost Part D plans are going way up in price.

Remember: Open enrollment Annual Election Period for selecting or switching Part D drug plans runs from Oct 15 to Dec 7th so keep this info in mind when you review your plans.

Want to sign up or switch your Medicare Part D plan? Visit www.medicare.gov Just type in your meds, compare prices, and choose the best plan for you. You can also see plan info at PlanEnroll.com

Waived Part D Due to Work coverage? Watch out!

If you did not enroll in Medicare Part D because you had “credible” coverage from your employer or spouse, things may change in 2025. Your work drug coverage must be as good or better than a standard Medicare Part D drug plan to be considered credible. Now that the MOOP for Part D is $2000, many work plans will not be considered credible by Medicare. Ask your work to send something in writing stating that your work coverage drug plan satisfies Medicare’s definition of credible drug coverage for 2025. If your plan doesn’t comply, you will need to consider enrolling in a Part D drug plan for 2025 to avoid penalties in the future.

💡 Thinking about switching to Medigap?

Before applying, use our Medigap eligibility tool to check if you’re likely to be approved. It’s called the Instant Medigap Underwriting Checker, and it helps you avoid surprises by showing whether your health history could affect your approval. It’s fast, free, and gives you peace of mind before making a big move.