If you’re trying to choose among Medicare drug plans (Part D), you’re not alone. With dozens of options and changing drug costs, finding the right fit can seem confusing. This simple step-by-step guide helps you understand, compare, and confidently pick your ideal drug plan.

💡Note: Currently Senior65.com does not directly assist clients in Medicare Part D drug enrollment. This article is for educational purposes only. We created this step-by-step guide to help you complete your enrollment directly on Medicare.gov. We are still 100% committed to assisting with Medigap support enrollment.

Step-by-Step: How to Enroll in a Medicare Part D Plan

Follow these simple steps to choose your Medicare Part D plan and make sure your prescriptions are covered at the lowest total cost.

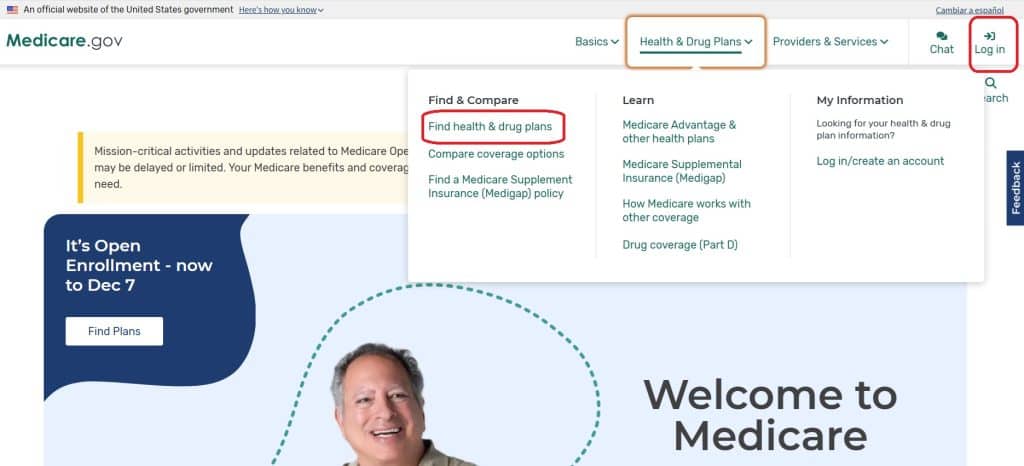

Step 1: Go to Medicare.gov

Visit the official Medicare.gov website. Click “Log in” if you already have an account, or choose “Find Health & Drug Plans” to start as a guest.

Step 2: Log In or Continue as Guest

If you have a Medicare.gov account, your medications will appear automatically. If not, you’ll need to enter them manually by adding your zip code under “continue without logging in.” Make sure the correct year is selected. In the example below, 2026 is selected.

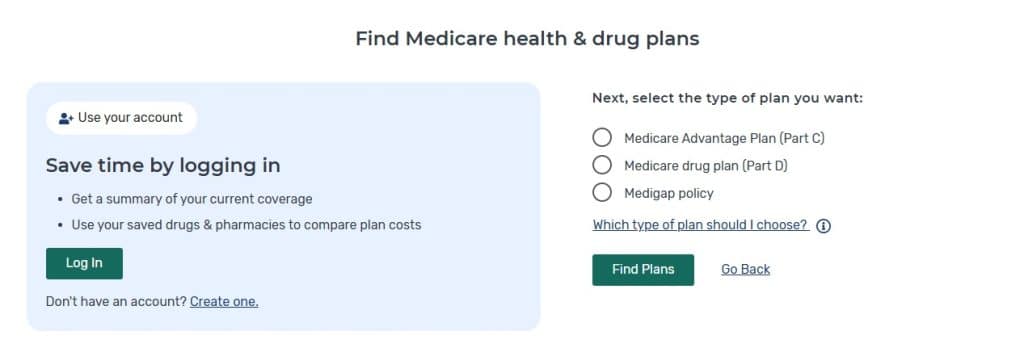

Step 3: Enter Your ZIP Code and Select “Medicare Drug Plan (Part D)”

Be sure to select the year you’re enrolling for (for example, 2026) and confirm that you’re comparing Medicare Drug Plans (Part D) — not Medicare Advantage or Medigap policy. In the example below, the correct circle to select is the middle one on the right next to the words: Medicare Drug Plan (Part D).

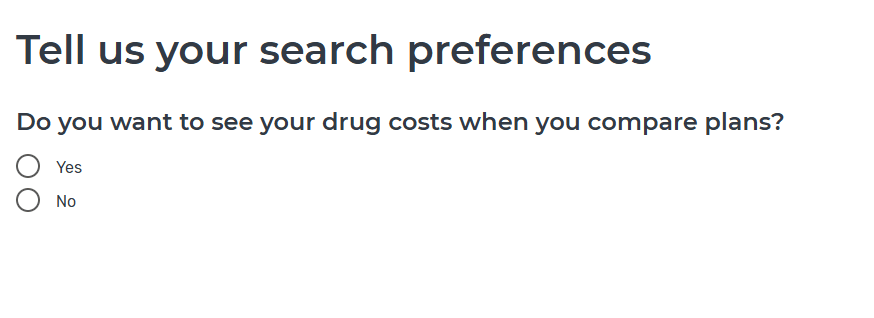

Step 4: Ask to Compare Drug Costs

The system will then ask if you get special help. Most people do not receive extra help paying for Part D but please mark this if this applies to you. Then select “yes” under “Do you want to see your drug costs when you compare plans?” as shown in the example below.

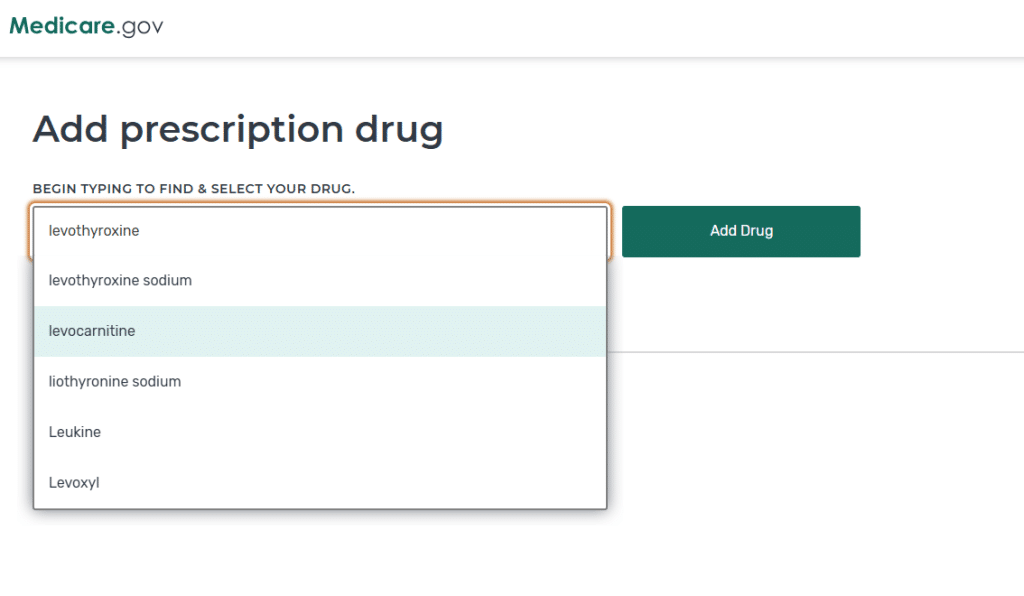

Step 5: Enter your Prescription Drugs

Get your list of drugs you plan on taking for the next year. Type the first few letters of your first drug. You will see a list of drugs appear directly below where you are typing to chose from. You MUST select your drug from the list by clicking on it. Even if you type the whole name of the drug, the system will not accept it unless you first click on the drug from the list below. In the example screenshot, we have clicked on “levocarnitine.” Once you select your drug, you may have the option to select a generic option. Usually the generic version of your drug will be less expensive.

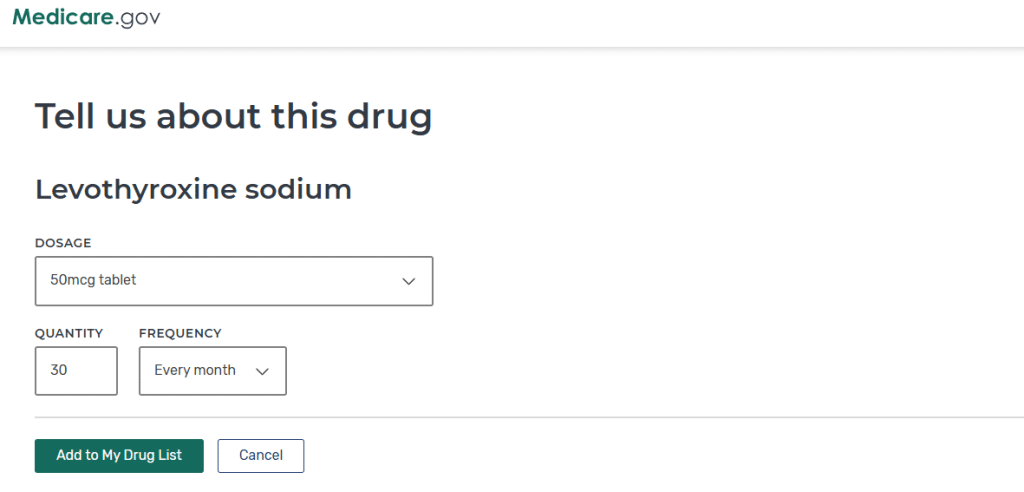

Step 6: Select your dosage and frequency

Use the dropdown to select the exact dosage you take. Be careful. The same dose could be available in capsule or tablet at drastically different costs so be accurate.

The system defaults to the most common dosage and frequency. The example below assumes 50mcg tablet 30 a month (same as once a day). If you take the drug twice a day, you must switch it to 60 every month. If your prescription is a tube of creme and you refill it about once a year, select “Quantity: 1, Frequency: Every 12 months”

Step 7: Click “Add to My Drug List”

Once you have the correct dosage, quantity and frequency, click on the green button “Add to My Drug List.” You can then “Add Another Drug” or click on the green “Done Adding Drugs” as shown below.

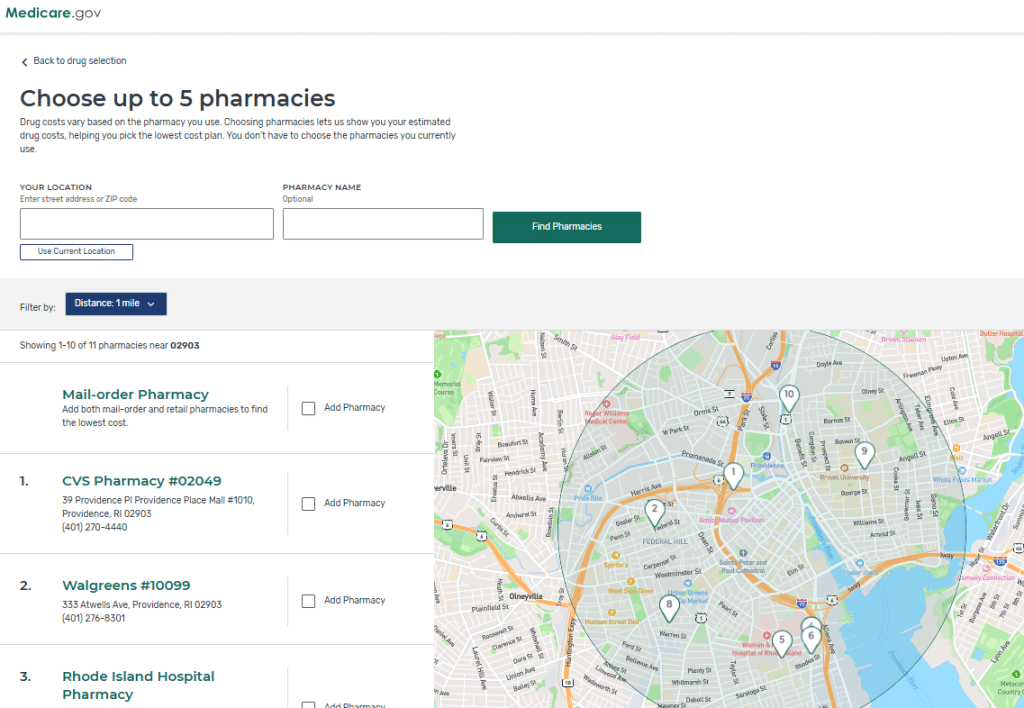

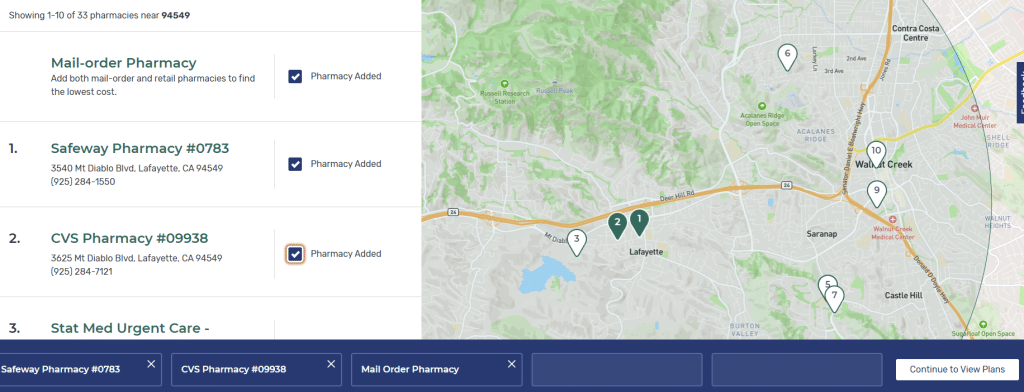

Step 8: Choose Your Pharmacies

Select your preferred pharmacies. We recommend also including the mail-order option if available. Mail order can sometimes (but not always) save you money on prescription charges. Choose different pharmacy chains (like Wallmart, CVS, or a local pharmacy) — prices can vary significantly so put in a few to compare.

Note: After you have selected your pharmacies, click on the “Continue to View Plans” blue section at the bottom right of the page.

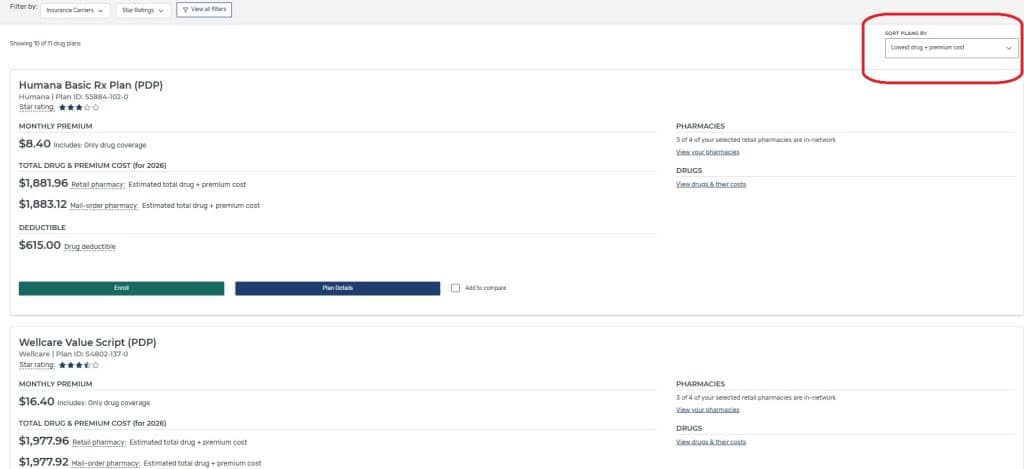

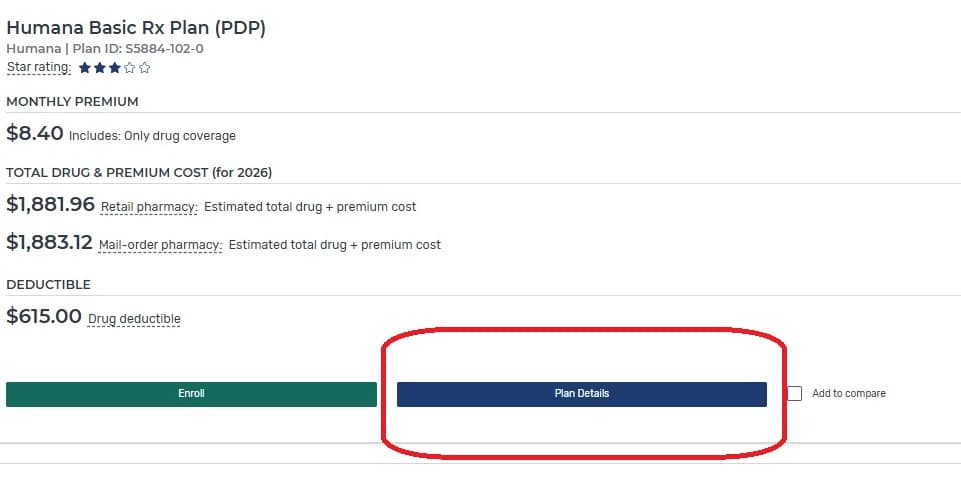

Step 9: Review Results

Medicare.gov usually already sorts results by total cost (drug + premium). This shows the plan with the lowest overall expense for you. In the example below, the estimated price is in second section on the left that says “1,881.96” under “Total Drug & Premium Costs for 2026.” Don’t rely on monthly premium alone — a $0 premium plan could end up costing thousands more in medication costs. You can change how results are sorted by clicking on the dropdown in the upper corner (here circled in red).

Step 10: Review Formulary and Deductible Details

Before enrolling, click Plan Details to confirm all your medications are “on formulary” (covered). Review the deductible amount and note whether your pharmacy is listed as “preferred in-network” — this can affect your total cost.

Step 11: Make sure all your drugs are covered!

In the screenshot example below, you can see that this sample plan “covers 0 out of 1 drugs” (circled in red). This means the person only submitted one drug but this plan will not cover it. The person will pay the entire amount for that drug with no insurance discount. Time to select a different plan! Click on “view drug coverage” to see how each plan will cover your drugs.

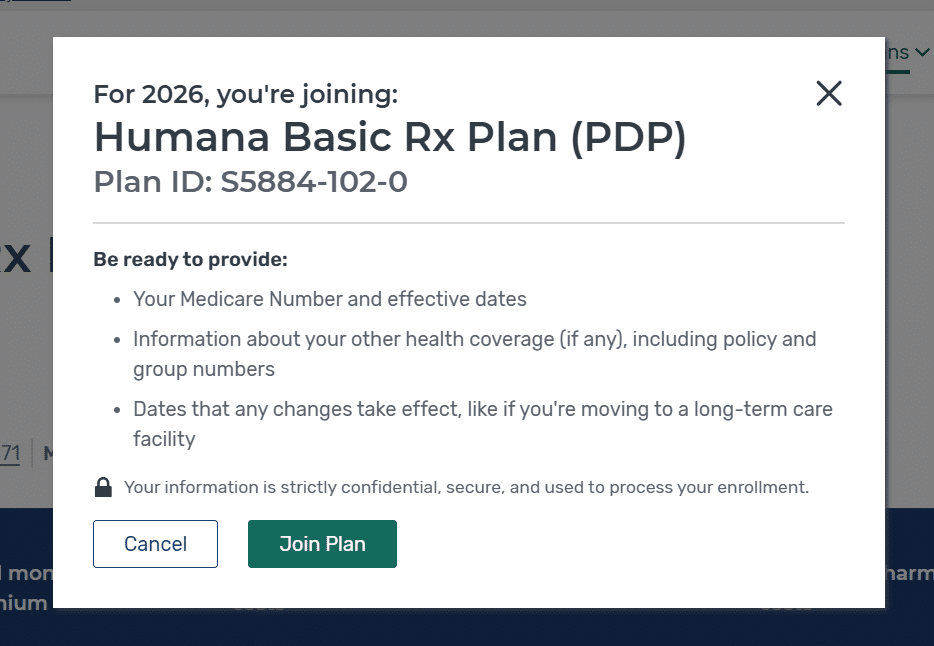

Step 8: Enroll Online (Optional)

If your current plan remains the lowest-cost option for next year, you don’t need to re-enroll — it will renew automatically. If another plan offers lower costs, click Enroll and follow the prompts to complete the process securely on Medicare.gov.

⚠️ Important: If you’re on a Medicare Advantage plan, do not sign up for a standalone Part D plan without guidance. Doing so can cancel your Medicare Advantage coverage and affect your Medigap eligibility.

💡 Reminder: Senior65.com does not enroll clients in Part D plans. We are Medigap experts and are here to help you with all your Medicare Supplement insurance needs. This Part D drug enrollment guide is here to help you complete the process independently on Medicare.gov.

Common Mistakes to Avoid

- Enrolling in a standalone Part D plan while still on Medicare Advantage. Unless you are planning on leaving Medicare Advantage, don’t enroll in Part D.

- Choosing based only on monthly premium instead of total yearly cost.

- Assuming your plan from last year hasn’t changed. Plans can change which drugs they cover, which pharmacies they work with and how much they charge each year.

FAQs — Medicare Drug Plans (Part D) Enrollment

Q: Can Senior65.com help me sign up for Medicare Drug plans?

A: No. Senior65.com specializes in Medigap (Medicare Supplement) plans. To enroll in Part D, visit Medicare.gov directly.

Q: When can I change my Medicare Drug plans?

A: During the Annual Enrollment Period — October 15 to December 7 each year or if you qualify for a Special Enrollment Period.

Q: What if my medications change midyear?

A: You can request a formulary exception through your plan, or switch to a new plan during the next AEP. Also check out discount programs with your drug manufacturer, Good RX or Cost Plus Drugs.

Q: What if I don’t take any medications?

A: You should still enroll in a low-cost plan to avoid future late penalties.

Q: How do I know if my current plan is still the best for next year?

A: Log into your Medicare.gov account — it automatically compares your current plan’s costs for the upcoming year.

Need Help with Medigap?

If you’re exploring Medigap (Medicare Supplement) options to complement your Medicare coverage, we can help. Click here for an instant Medigap quote or call 800-930-7956 for friendly, free guidance.

Note: Medicoverage Inc and Senior65.com are not endorsed by the Centers for Medicare & Medicaid Services (CMS), the Department of Health and Human Services (DHHS) or any other government agency.